How to Use GCash Save Money (GSave) – An Essential Guide

Welcome to digital banking! Do you know that you can save money thru your GCash app on your smartphone? Banking thru GCash Save Money or GSave is very much different from the way we do it traditionally with typical banks.

The process from registration to depositing money can be completed in just a few minutes!

You can do it anytime and anywhere- in the comfort of your home, in the office, or even while shopping in malls as long as you are online.

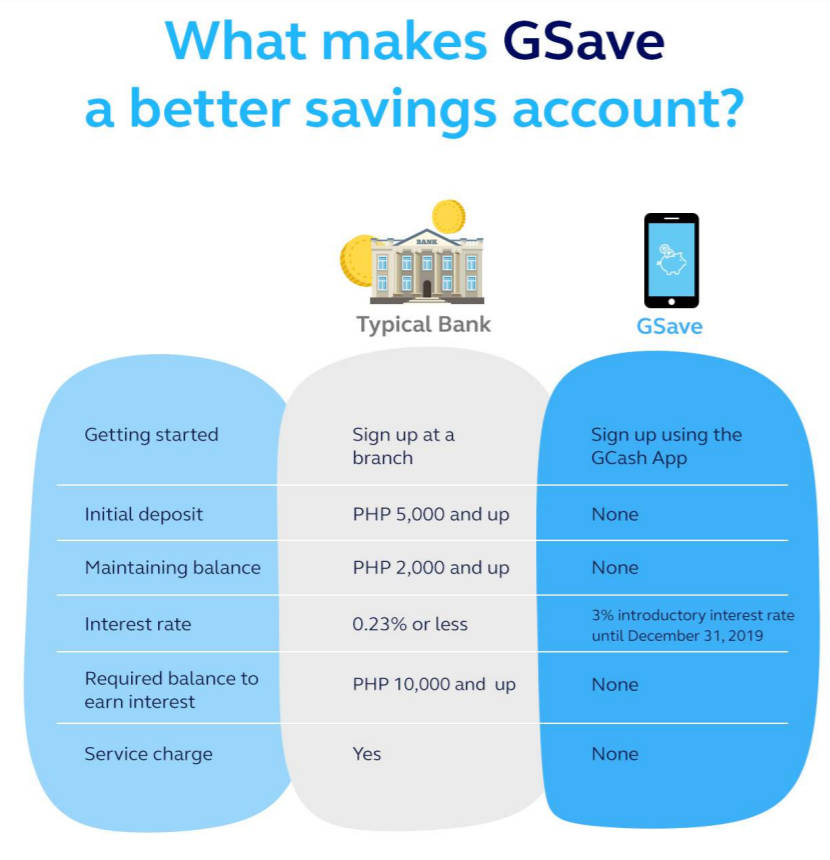

Saving thru GCash is very convenient than opening an account in typical banks where you have to be physically there and the process takes around one to two hours.

In addition, you will also be required to have an initial deposit which is not the case with GCash Save Money.

If you don’t have a GCash account yet, you can register thru this link: Create an account with GCash.

In this post, I will share the essential details on how you can use GCash Save Money to start your saving habit for this year.

You may also check this post on how to register a GCash account: Tutorial: How to Install and Register an Account in GCash.

What is GCash Save Money Feature?

Save Money is a fully digital feature of GCash which is available for Semi and Fully Verified GCash users. It is a savings program in partnership with CIMB Bank which is one of ASEAN’s largest banks.

CIMB is also a member of PDIC which means that all deposits are insured up to Php 500,000.00. Also, GCash and CIMB are both regulated by the Bangko Sentral ng Pilipinas.

Below are the awesome things that you should know about Save Money :

- Interest Rate is 2.60% p.a. (Note: When this post was published, the base interest is 3.10%. There are promos that currently provide 4.00% interest rate to GSave users. You may check the official social media accounts of GCash for updates.)

- No initial deposit to open an account

- No minimum deposit required

- No maintaining balance required

- No service fees to open the account

- No service fee to maintain the account

- Maximum daily withdrawal: Php 50,000.00

- Maximum deposit limit: Php 100,000.00 over 12 months

How to register to GCash Save Money

It is very easy to register to GCash Save Money. However, please note that to avail of this feature, you should be a semi or fully verified GCash user. Please follow the steps below:

- Log in to your GCash account.

- In the GCash Dashboard, select Save Money (Please see the screenshot below). If Save Money is not displayed, select Show More. If your email address is not confirmed yet, a message box will display asking you to update your email address. To confirm, you have to select UPDATE NOW. GCash will send a verification code to your registered email address.

- Selecting Save Money will display the My Savings Account screen.

- In My Savings Account screen (See screenshot below), a welcome message will be displayed: “Welcome to the Savings feature in GCash! Allow us to introduce what you can do with Save Money. Are you ready?”

- Select LET’S GO. This will display an informational message: “Here’s what you can do with Save Money. Enjoy the highest interest rates in the country at 3.0% annually (over 10x higher than regular banks!). Deposit and withdraw anytime!”

- Select Tap to continue to move to the next message until the button OPEN A SAVINGS ACCOUNT is displayed.

- Select OPEN A SAVINGS ACCOUNT. This will open the Confirmation screen (Please see the screenshot below). At the bottom of the screen it displays: “By proceeding, you agree to open a Save Money account, subject to its Terms and Conditions.” You may click Terms and Conditions to check the terms of this GCash feature.

- Select OPEN A SAVINGS ACCOUNT. This will display a screen confirming that your savings account is now opened.

- Select OK to finish the registration. A confirmation message will be sent to your registered mobile number and email account.

- From the GCash Dashboard, open again the My Savings Account screen. You will see the following fields:

- Total Savings Balance: Php 0.00

- Account No:

- Annual Interest Rate: 3.1% p.a. (Update: Base interest is now 2.60%)

Congrats! You have a GCash Save Money account now! Awesome!

How to deposit an amount to GCash Save Money

- Select Save Money from the GCash Dashboard. This will open the My Savings Account screen. (Note: If Save Money is not displayed, select Show More to display its icon).

- Select DEPOSIT.

- Type your desired amount. Your GSave Account total balance is displayed for your reference.

- Select NEXT. This will display the Confirmation page. Check if the amount displayed is correct.

- Select CONFIRM.

- A confirmation message will display: “GSave Deposit Success! You will receive an SMS to confirm your transaction.”

- Select OK. GCash will send an SMS confirming the transaction.

How to withdraw an amount from GCash Save Money

- From the GCash Dashboard, select Save Money. This will display My Savings Account screen.

- Select WITHDRAW.

- Enter your desired amount.

- Select NEXT. This will display the Confirmation page. Check if the amount is correct.

- Select CONFIRM. GCash will send an SMS notification of your OTP (one-time-password) to your registered phone number.

- In the Authentication screen, select Submit Code.

- GCash will send an SMS confirming the transaction. The amount that was withdrawn will be transferred to your GCash wallet.

How to monitor your account

You can keep track of your savings by selecting Transaction History in My Savings Account screen. It will display a real-time list of your latest GSave transactions.

You can also request a record of your transaction history sent thru email. Here’s how to do it:

- In My Savings Account screen, select Transaction History.

- In Transaction History screen, select the Mail icon located at the right side of the heading ‘Transactions as of MM-DD-YYYY.’ This will display the Request Transactions screen. Email To field is already auto-populated with your registered email address.

- In the No of Days field, tap on Select No. of Days button.

- Select your desired date range. The options are a) Last 7 days, b) Last 30 days, c) Last 60 days, d) Custom. Select Custom if you wish to enter the specific From and To dates.

- Select CONFIRM. A confirmation page will display: “GSave Transaction History Request Success! The file will be sent to your email.”

- Select OK to return to My Savings Account screen.

GCash will send a PDF file to your registered email address. For security reasons, the file requires a password to open it and this will be explained in the body of the email.

Final Thoughts

Using GCash Save Money or GSave is my very first ‘fully’ digital banking experience. It is just amazing! It’s a far cry from the usual transactions that we normally do with physical banks. In addition, opening an account requires no initial or minimum deposit.

Below is a comparison between saving with a typical bank and GSave:

What’s the best reason to put your money in GCash Save Money? The answer is its interest rate. At the time when I opened the account, it’s at 3.1% p.a which is way better than most savings programs I know. (Note: Base interest rate is now 2.60%). Below is the sample computation of interest rate from GCash GSave:

Based on the above, we have more reasons to start now our saving journey in order to attain our financial goals in life.

To know more, you may check the GCash website: GCash.

What’s the next step after opening a GCash Save Money account?

GCash Save Money or GSave has two types – the GSave Lite Account and the GSave Full Account. A GSave depositor cannot open both the GSave Lite Account and the GSave Full Account at the same time.

The above registration process which is opened thru the GCash app is for the GSave Lite Account. It has an aggregate limit of Php100,000.00 and a validity of 12 months. On the other hand, upgrade done thru CIMB from GCash converts it to GCash Full Account. Depositors will undergo the full Know Your Customer (KYC) process of CIMB thru the CIMB OCTO Mobile Application.

After upgrading your GSave Lite Account to GSave Full Account, the Php100,000 aggregate deposit limit and the 12-month validity period for the GSave Lite Account will be removed and will not anymore be applicable.

I have already upgraded my account to GCash Full Account. I am very excited to share it with you in the next post. Stay tuned and have a nice day!

Hi,

I am a newly Gcash user ,but my piggy bank is still empty and it says there that i should have Gcash coins to load my piggy bank which coming from my rebates that im gonna earn in a month, so my question is how can i convert my rebates into Gcash coins and how can i start my piggy bank,,..Thank you

Hi Shierna,

Thanks for visiting this blog. Though I am a regular user of GCash, My Piggy Bank is also empty. The rebates that I have received are automatically credited to my GCash balance.

I’ve checked the GCash Help Center and the Piggy Bank screen in the GCash app. As I understand it, the GCash Coins go to the Piggy Bank and are stored there so I believe there is no need to convert. Then, we can transfer the GCash Coins to our savings account by redeeming it. Here are the articles from the Help Center:

https://help.gcash.com/hc/en-us/articles/360035928754-What-is-GCash-Coins-

https://help.gcash.com/hc/en-us/articles/360035928774-How-do-I-redeem-my-GCash-Coins-

Hope this helps. I will comment here again if ever some of the rewards that I would get in the future will be in the form of GCash Coins. Thanks again. 🙂

Is there a fee if I withdraw my funds from Gcash save money?

Hello Jorge,

Thanks for visiting this blog. There is no fee because when we withdraw funds, we are just transferring money from GCash Save Money to our GCash account.

Hi,

Would like to ask the frequency of posting the earned interest. I mean, is it monthly or annually?

Also, how will I be able to see it? Will there be a message in the GCash inbox informing me when the interest earned is posted or will it be posted in the transaction history pane of the GCash Save module?

Thank you!

Hello Ranie,

Thanks for visiting The Wise Coin! The earned interest is posted monthly.

You can find the details in the Transaction History of Save Money/ My Savings Account screen. It is here that the Tax on Interest is also displayed.

I don’t remember receiving any message in the GCash inbox about posting. I’ve checked it right now to confirm and yes, there are no messages coming from GSave. Hope this helps. Thanks again. 🙂

I cant open my gcash account. And always say maximum attempts. I already have a temporary MPIN and i successfully open it

But then i supposedly change my MPIN but it says i already enter maximum attempt again. Please help

Hello Marone,

Thanks for visiting this website. If you have already tried the Forgot MPIN link of GCash and it did not work, I think you need to contact the official GCash support. Here is the link that might help: What do I do if cannot access my account?.

Hellow .Good day! I deposited my money in Gcash save money ang I’d like to transfer the entire amount to gcash dashboard so that I can withdraw it into cash but the problem is that I lost my simcard and only to find out that it needs a verification code thru SMS notification. What should I do for this? Thank you 😊

Hello Glory,

You really need your registered mobile number for that withdrawal transaction to be successful. The best thing to do is to contact GCash Support. They will ‘temporarily suspend your GCash account for your safety’. Here is the link from the GCash Help Center that describes the process: I lost my SIM/phone. What do I do? Thanks for visiting The Wise Coin. 🙂

Hi! Just wanted to ask what you mean with 12-month validity period for the Gsave Lite account? Does this mean that you have to upgrade your Gsave Lite account to Gsave Full before the 12-month validity ends? Does that also mean that you should already have P100,000 in Gsave Lite to upgrade it so Gsave Full?

Hello Faith,

Thanks for visiting The Wise Coin!

According to CIMB Bank, the partner bank of GCash, the 12-month validity means that after 12 months, your account will be closed if there are no funds in your account.

In case you still have balance, your account will be blocked and will expire. You can still withdraw the funds but you can’t deposit anymore.

Here is the exact words from CIMB Bank: “If you have existing balances in your GSave account but did not upgrade within the 12 month validity period, your GSave account will expire and it will be blocked. This means you will only be able to withdraw or transfer funds out of your GSave account.”

Yes, it is better to upgrade your GSave account before it expires if you really want to maintain it. Upgrading means linking it to CIMB and undergoing the verification process of the bank. It’s very easy and I have shared my experience in this post:

How to Open a CIMB Bank Account

“Does that also mean that you should already have P100,000 in Gsave Lite to upgrade it so Gsave Full?” No. In fact, I only have P500 in my account when it was upgraded. 🙂

If you want to know more, you may visit the GCash Help Center or the CIMB Bank PH official site. Thanks again Faith.

Hi! Great post! I just wanted to ask something. Can I receive wire transfers internationally with my GCash Save Money Account No.? If so, can you tell me about your experience with something like that if any?

Thanks, MariaMaria for your kind words! Currently, I’m not aware of any method to receive international wire transfers thru GCash Save Money. As I see it right now, the source of funds for GCash Save Money still comes from the main GCash Wallet. Alternatively, you may receive remittance or cash in to your GCash account, then transfer the funds to GCash Save Money. You may check out this post on how to cash in to GCash: How to Cash In to GCash – An Essential Guide. Thanks again for visiting The Wise Coin. Really appreciate it.

I have php1,00 in my save money how long to have a interest or what is the interest of php 1,00 in per annum?

Hello April. The interest is paid out monthly. In my case, I receive the interest every first day of the month.

Regarding the computation, you may check the Final Thoughts section of this post. There is an infographic that clearly illustrates how the interest is computed. It also considers the tax on interest in the final interest earned. That illustration came from GCash Save Money Primer sent to new GSave account holders. By the way, the base interest right now is 3.1 p.a. but 4% p.a. is achievable thru promos. Thank you for visiting The Wise Coin and happy saving! 🙂

hi may i ask on how to retrieve money from gsave if the phone and mobile number was lost.?

Hello sherin,

Thanks so much for visiting The Wise Coin! You may contact and submit a ticket to GCash Help Center. Here is the GCash Help Center article that provides the steps related to your concern: What should I do if I lost my SIM/phone?. Hope that helps. Thanks again.

My piggybank is still empty. And it says that some of my rewards can come in the form of Gcash coins. May I know how to gain rewards or coins? Thanks.

Hi Gem,

We have the same experience. My Piggy Bank is also still empty. I use GCash on a regular basis and honestly, I haven’t received any GCash Coins. According to the GCash Help Center, GCash Coins can be collected from different promos. Perhaps we haven’t availed yet of any promo that provides GCash Coins as rewards. I will add that feature to this blog post once I get GCash Coins. Thanks a lot for visiting The Wise Coin!

Hi i would like to ask how can i edit my email address? It appeared erroneous and i cant receive verification code.

It was encoded yahoo.com.ph

But Should only be yahoo.com

Please help

Thank you

Hello Beng,

I’m not sure if you can still re-enter the email address. If it’s not anymore available, it’s best to contact CIMB Support #2462. According to CIMB: “Local calls are toll-free for Globe, Smart, and PLDT subscribers nationwide.” Hope this helps. Thanks for visiting The Wise Coin!