Review: Money Manager Budget Tracker App

App Name: Money Manager

Developer: Realbyte Inc

Platform: Android

Price: Free

Download Link: Money Manager

Money Manager is a budgeting and expense tracking app for Android and IOS. I have personally been using this app for more than a year now. It’s helpful especially in tracking my expenses and checking the areas where there are financial leaks. You can better organize financial accounts including cash, bank, credit cards, loans, or even your savings such as GCash GSave and CIMB. You can easily track budget and expenses with its daily, weekly, instant statistics, and downloadable Excel files.

Design and user interface of Money Manager

Money Manager has well-organized menus and tabs. The main menus are found at the bottom toolbar that includes Trans, Stats, Accounts, and Settings.

Trans is the default menu when opening the app. It displays various tabs with headings found at the top including Daily, Calendar, Weekly, Monthly and Total. Every tab displays the columns Income, Expenses, and Total.

The default tab is Daily which is a recording of all daily transactions. Calendar displays all days of the current month and for each day, the total income and expense. Weekly and Monthly tabs show transactions filtered by week and by month, respectively. The Total tab compares the expenses for the last month with that of the current. The sum of all the following is also listed: Cash Expenses, Card Expenses, and Savings/Investment/Insurance/Loan.

Stats menu includes a graphical representation of all income and expenses. More of this in the review below.

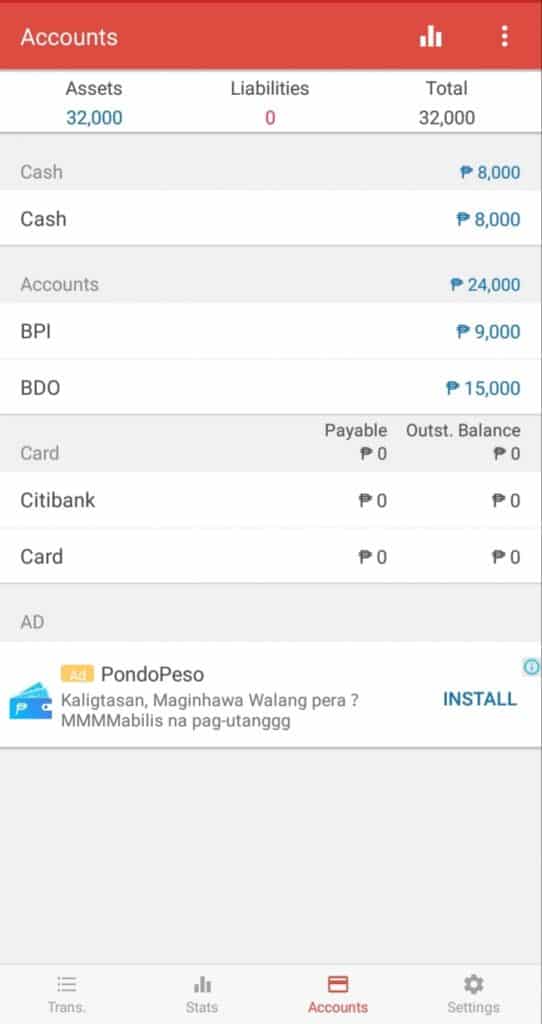

The Accounts menu is where the user can view the different financial accounts and the current total for each. This is very useful when checking the status of individual accounts. For example, one can easily verify the total payable for a credit card for a certain period of time. In addition, clicking the graph icon at the top redirects the user to a statistical page. This page contains a line and a bar graph representing the status and movement of the total balance for 6 months.

The Settings menu is where the various settings can be configured including accounts, passcode, backup, style, etc.

Simplicity and ease of use of Money Manager

Using Money Manager is very intuitive. Navigating the app is easy with its well-designed menus and tabs. Placing the main menus at the bottom bar makes clicking them easier when using a smartphone. The topmost bar houses the icons. This is a good location. I seldom use these icons.

Every tab of the Trans menu displays the + icon. This makes adding a transaction easy and practical. However, Realbyte Inc can further improve this by also placing this icon on the other menus or screens. For example, a user can add a transaction easily even when the Stats menu is currently displayed.

Important features of Money Manager

Passcode

Money Manager requires a passcode when opening it if this feature is activated in the settings. This makes your personal financial information secured and protected. You can turn this on or off in Settings > Passcode.

Personal account management

Money Manager requires the account when entering an income or expense transaction. Once saved, the app records this in that particular account and shows the info in the tabs, stats, and reports. For example, if you buy coffee thru cash, the app records this as an expense in Cash account.

When adding a salary transaction, the app records this as an income in the specified bank account. Another example is when you pay for a credit card monthly due thru online banking. For this, I use ‘Transfer.’ The app records the transfer of the amount from that bank account to the credit card.

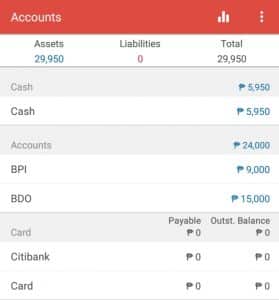

Let’s have an example. Current cash is 6,450.00.

I bought a pizza for 500.00. So I added an expense of 500.00:

Once saved, 500.00 will be reflected as an expense in Trans menu:

The above transaction will automatically be reflected in Stats:

Then, the transaction will also be deducted as an expense in Accounts > Cash:

Statistics

This feature is one of my favorites in this app. Income and Expense are the 2 tabs on this page. I regularly use the latter. You can filter both tabs into weekly, monthly (default), yearly, and periodically. Let’s have Expenses as an example.

The top portion graphically displays the numerical proportion of all expenses for a given period of time with categories and percentages. Clicking a specific pie somewhat detaches it and displays its amount. The bottom part shows a listing of the categories and the actual amounts. Clicking an item in the list redirects to another page and displays the details of that category.

Backup and restore

There are many ways to backup and restore the saved Money Manager files. These include using Google Drive, saving them in your device, and exporting to an email account.

Conclusion

Money Manager is really a great app. It helped me a lot in monitoring my expenses. With it, I was able to determine my monthly budget and to find the areas where there are financial leaks or unnecessary expenses.

If you don’t have yet a budgeting and expense tracking app or if you want to try a different one, Money Manager is a good choice. It’s easy to add transactions in Money Manager and these are integrated well with the whole app. The best part, you can install and use it for free.

Ok