How to Open a CIMB Bank Account

Welcome to digital banking! In this post, I’m very much excited to share with you the details on how to open a CIMB Bank account.

Why CIMB Bank?

Nowadays, we are at the forefront of great digital innovations in Fintech.

We can do banking using our smartphones in the comfort of our homes, in the office, at the mall, abroad, or any place in the world as long as we are online.

Not only is the location being diminished as a barrier in performing financial transactions. Time has also ceased as a hindrance as we can do transactions anytime.

Thru CIMB, one can perform fully-digital bank transactions like opening an account, depositing money, withdrawing funds, and many more!

Not only that, a few physical or digital banks can match the interest rate that they offer to their depositors.

Table of Contents

A. Things you need to know about CIMB

CIMB stands for Commerce International Merchant Bankers, a universal bank based on Kuala Lumpur, Malaysia. Its main entity is CIMB Group Holdings Berhad. One of its sub-entities is CIMB Bank which is a consumer bank based in several countries in the ASEAN region including Malaysia, Singapore, and the Philippines.

The CIMB Bank in the Philippines is called CIMB Bank Philippines (PH). It is a multi-awarded digital and mobile bank in the country. CIMB’s awards are Global Finance’s Best Digital Consumer Bank, Asian Banker’s Best Digital Bank, and International Finance’s Fastest Growing Digital Bank Award.

B. Ways to open a CIMB account

There are two ways to open a CIMB Bank account.

First, if you already have an existing GCash Save Money (GSave), you can link and upgrade that account to CIMB Bank mobile app. This is the process that I’ve done to open a CIMB Bank account.

Remember that the GSave account created in GCash is not a full account. It is a GSave Lite Account with an aggregate limit of just Php100,000.00 and validity of one year. However, if you link it to CIMB and upgrade it in the CIMB app, it will be converted to GCash Full Account.

| App, Features and Services | GSave Account | Upgraded GSave Account |

| Mobile App | GCash | CIMB |

| Validity | 12 months | Unlimited |

| Deposit Limit | Cumulative deposit limited to Php 100,000 | Unlimited |

| Additional requirements | None | Additional personal info, digital signature and virtual verification |

| Account Number | Same | Same |

After I opened a GCash Save Money (GSave) account, I immediately received an SMS from CIMB Bank. It says “I-unlock and full features ng iyong account! As a last step, download the CIMB Bank PH App and link your GSave account now! Just log in the temporary credentials…” Included in the SMS is the temporary username (your registered mobile number) and the temporary password.

By the way, if you don’t have a GCash account yet, you can register thru this link: Create an account with GCash.

The second way to register and open an account is to directly do it in the CIMB Bank app.

C. Open a CIMB account by linking and upgrading your GCash Account

1. Prepare the requirements

If you don’t have yet a GCash Save Money (GSave) account, you may check out this post: How to Use GCash Save Money (GSave) – An Essential Guide.

To upgrade your GCash Save Money (GSave) account, you need to prepare 1 valid ID. The following are the accepted IDs for verification:

- Driver’s License

- Passport

- Professional Regulation Commission (PRC) ID

- Unified Multipurpose ID (UMID)

- Postal ID (plastic type)

- Voter’s (COMELEC) ID Card

- Government Office ID or GOCC ID

- Integrated Bar of the Philippines ID

- Overseas Worker’s Welfare Administration ID (OWWA ID)

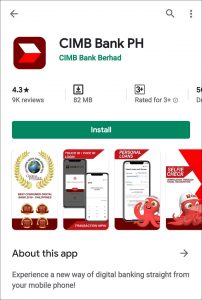

2. Install the CIMB app

- Open Google Play Store in your Android device (App Store in IOS). In this tutorial, installation is from Play Store.

- Search for and select CIMB Bank PH in the search box.

- Select Install.

- Select Open once the app is installed and the Open button is displayed.

3. Create an account

- After selecting Open, the CIMB Welcome screen will display.

- Tap on Login. This will open the CIMB Bank Login page.

- In the Username field, enter your registered mobile number in GCash. Note that this is the last 10 digits of your number.

- In the Password field, enter the temporary password sent by CIMB thru SMS.

- Tap on Login. This will open the Login Credentials screen.

- Enter the following:

- Username

- Password (enter and re-enter)

- Mother’s Maiden Name (this will be used as a security question)

- Gender

- Tap on the Option button stating ‘I have read, fully understood and agreed to the Terms and Conditions.’

- Tap on Update. This will open the Mobile Number Verification screen.

- An OTP will be sent to your registered mobile number.

- Enter the 6-digit OTP. This will open the Email Verification screen.

- Check the email displayed and make sure it is correct.

- Tap on Confirm. This will display the information message: ‘To verify your email address, please check on the link we’ve sent to <your email address>’

- Check your email and verify thru the link provided in CIMB’s message.

- Once the email is verified, the MPIN screen will display.

- Enter your 6-digit MPIN. This will open the confirmation page stating that ‘All Done! You’re now ready to use CIMB Bank app!’

- Tap on the Homepage. This will open the CIMB Bank app. Octo will welcome you with an option to initially check and navigate the app.

4. Verify your new CIMB account

- After the ‘mini’ tutorial, a pop up message will display with Octo inviting you to verify your account.

- Select Get Verified. This will open the Upgrade GSave Account screen. Here, you will see the difference between the GSave Lite Account and the Upgraded GSave Account.

- Tap on the Option button stating ‘I have read, fully understood and agreed to the Terms and Conditions.’

- Tap on Next. On the next page, you have to enter the required information to verify your CIMB account.

- Enter the following details:

- Civil Status

- Place of Birth

- Employment Type. Options are:

- Government

- Private Sector

- Self-employed

- NGO

- Unemployed

- Student

- Housewife

- Nature of Work

- Employer Name

- ID Type

- ID Number of the selected ID Type above

- Tap on Next. This will open the Additional Details screen.

- Enter the following details:

- Purpose of Account Opening

- Your Average Monthly Income

- Anticipated Monthly Transactions

- Tap on Next. This will open the Digital Signature screen.

- You have 2 options for entering your signature:

- Sign the signature in the space provided

- Sign on a piece of paper and take a photo of the signature

- I took the option of taking a photo of my signature as I find it much easier.

- Tap on Next once done with the signature. This will open the Virtual Verification screen.

- Tap on Take a selfie. This will display the Take a Selfie screen.

- Follow the following verification steps. Instructions are provided for each step. Tap on Let’s Start! button once you’re ready.

- Provide a photo ID;

- Validity Check;

- Liveness Check

- After completing the verification, a confirmation screen will display stating that you’re done with the verification and CIMB is currently processing the application. It also states that notification will be sent within 10 minutes. Approval of my application took less than 10 minutes.

- Once approved, you may now log in to the CIMB Bank app. You can now perform full-featured digital banking with CIMB Bank.

D. Open a CIMB account by registering directly in the CIMB mobile app

1. CIMB account types

The process of opening an account directly in the CIMB Bank app is almost the same as that with linking your GCash Save Money to CIMB. The only difference is that you don’t have a temporary username and password.

Instead of GCash GSave, the two account types that you can create are the Fast Account and UpSave Account. What’s the difference?

CIMB Fast Account has a validity of only 12 months. As the name implies, it has a fast application process of just 10 minutes.

Fast Account has also a free VISA Debit Card after cashing in a cumulative amount of Php 100,000.00. You can use the card to withdraw thru ATMs or purchasing thru POS terminals. The interest rate is 0.50% per annum. It has also a deposit limit of Php 100,000.00

The UpSave Account has no validity limit. This account requires a digital signature and virtual verification. It has no VISA Debit Card. However, it has a much higher interest rate at 2.50% per annum.

2. Steps in creating a CIMB Bank account

- Install and open the CIMB Bank app. This will display the CIMB Welcome screen.

- Select Create an Account.

- Select I need a bank account. This will display a screen where you can select the type of CIMB Account to open.

- Select either a Fast Account or an UpSave Account. You may tap on Compare to know the difference between the 2 accounts.

- After selecting the type of account, FATCA Declaration screen will display.

- FATCA Declaration has 2 questions that you have to answer ‘No’.

- Are you a resident or Citizen of the United States? (Yes, No)

- Are you a United States permanent resident cardholder? (Yes, No)

- Tap on Confirm. This will display the Sign Up screen.

- Enter the following details:

- First Name

- Surname

- Middle Name

- Mother’s Maiden Name

- Mobile Number

- Username

- To confirm, check the option button stating ‘I have read, fully understood and agreed to the Terms and Conditions.’

- Tap on Next. This will send an OTP to your registered mobile number.

- Enter the OTP. The next screen that will open is the Password Creation screen.

- Enter then re-enter your desired password.

- Tap on Next. Document Upload screen will display.

- Take a photo of your ID.

- Tap on Next.

- Complete the email verification. This is the last step if you selected Fast Account. However, you can upgrade this to Fast Plus Account by doing the virtual verification process. For UpSave Account, the next step is virtual verification. You may check the section above on how to perform virtual verification.

Conclusion

It’s quite amazing that I was able to link my GCash Save Money (GSave) to CIMB Bank in just a few minutes.

I was able to create and verify my CIMB Bank without leaving our home and going to a physical bank.

I’m now excited to try the other CIMB account types and share my experience in the next post. How about you? Have you tried digital banking with CIMB or other banks?

For more information, you may check out: CIMB Bank Philippines.

Updates

According to CIMB’s website: Effective June 1 to July 31, 2020, interest rate of 4% p.a. will be enjoyed by UpSave and GSave account holders with a balance of at least PHP 100,000.

Effective June 1, 2020, the base interest rate is at 3% p.a. for UpSave account holders and 3.1% p.a. for GSave account holders.

Fast Plus Account free VISA Debit Card is now available after cashing in a cumulative amount of Php 100,000.00. Before, the amount was only Php 1,000.00. Interest rate is currently at 0.75%.

3 Responses

[…] The best thing about carpooling is that you can save a lot. The money saved can be deposited in a savings account such as GCash GSave or CIMB. […]

[…] accounts including cash, bank, credit cards, loans, or even your savings such as GCash GSave and CIMB. You can easily track budget and expenses with its daily, weekly, instant statistics, and […]

[…] An emergency fund is equal to 3 months worth of expenses at the minimum. If we only allot a small percentage of our salary to building this fund, it will take several months. For example, after tracking your expenses, you realized that you spend 90% of your salary on necessary expenses. It means that you can only allocate 10% for building an emergency fund. Therefore, to build a month’s worth of emergency fund, it will take around 9 to 10 months. You can put your funds in digital savings account like GCash GSave or CIMB. […]