How to Fully Verify GCash Account

I have been using my Globe GCash account for some time now. I used it normally for loading my own or my family members’ smartphones. However, as more establishments are already opening cashless features, there is a need to upgrade and fully verify my GCash account.

In this post, I’m going to share with you the step-by-step on how to upgrade your GCash account.

The process is very easy and fast. In fact, I have done it in just a few minutes.

The best part? I was able to avail of the many features of GCash. Some of these features are unfamiliar to me during the time that I have upgraded my account.

Are you ready? Let’s go!

Table of Contents

A. Why fully verify your GCash account?

In the past months, various features were rolled out which were not accessible because my account was not fully verified. Some of these features are GSave, GCash Forest, Invest Money, etc. These and all other features will become available once I verify my GCash account.

Aside from the above, another reason to verify GCash is for account security and protection. The KYC (Know Your Customer) is the process of validating the identity of a GCash user thru providing valid identification, taking a selfie, filling in personal information, etc. To quote from GCash Verification Levels screen:

“Bangko Sentral ng Pilipinas requires all financial institutions to perform a few simple steps to protect against financial crime and to ensure your account security. It should only take a few minutes.”

Below is the step-by-step guide on how to fully verify your GCash account.

If you don’t have a GCash account yet, you can register thru this link: Create an account with GCash.

You may also check this post on how to register a GCash account: Tutorial: How to Install and Register an Account in GCash

B. Steps to fully verify your GCash account

1. Prepare a valid ID

Before starting to verify GCash, you should prepare any of the IDs listed below. Of course, your ID should be active.

- UMID

- Driver’s License

- Philhealth Card

- SSS ID

- Passport

- TIN ID

- Voter’s ID

- Student’s ID

- Alien/Immigrant CoR

- NBI Clearance

- Postal ID

- PRC ID

- Police Clearance

- Government Office/GOCC ID

- Company ID

- HDMF ID (Pagibig)

- Barangay Certification

- AFP ID

2. Log in to your GCash account

Once you have decided on what valid ID to use for verification, it’s time to log in to your GCash Account. Enter your registered mobile number, then click Next.

3. Open the main menu

The main menu is located at the upper-left corner of the main GCash screen. Tap it to open the submenus and buttons available including Verify Now.

4. Tap ‘Verify Now’

The Verify Now button is located at the upper-left portion of the menu screen just below the area for your picture.

After tapping Verify Now button, Get Verified screen will display.

5. Tap ‘Get Fully Verified’

Get Fully Verified button is located at the lower portion of the Get Verified screen.

Tapping the Get Fully Verified button will open the Choose an ID screen.

6. Choose your valid ID to Fully Verify GCash

In the Choose an ID screen, the list of recommended IDs are displayed. You may tap See more available ID button to view other qualified IDs.

After selecting and tapping the type of ID, Take Photo screen will display.

7. Take a photo of your ID

Position the ID within the provided frame and tap the camera button.

8. Take a Selfie

Once done with Step 7, Scan Face screen will display. Tap NEXT button.

Taking a selfie will be very quick. Just position your face within the provided frame and the application will do the rest of the process.

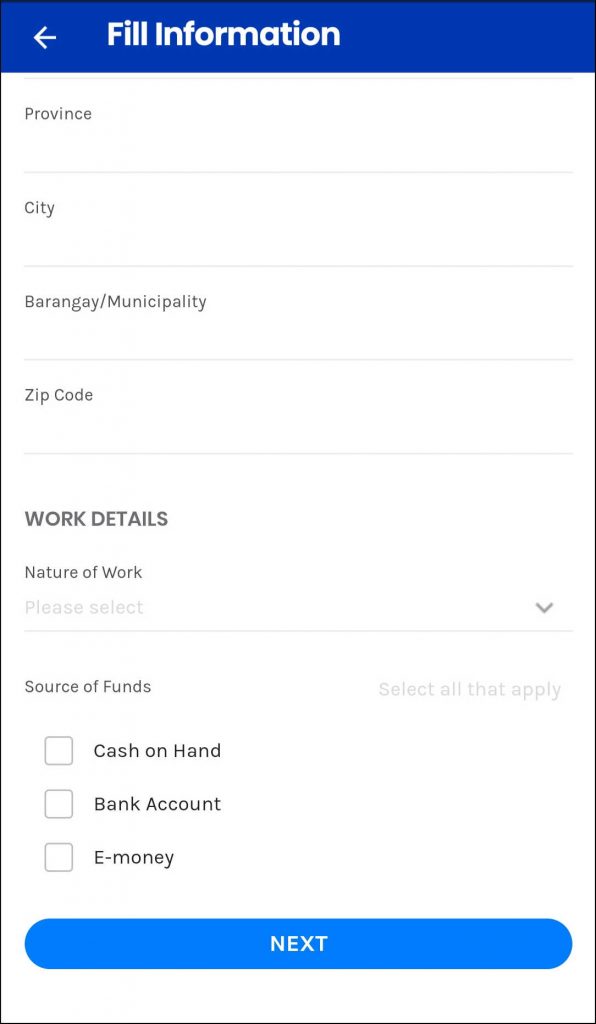

9. Fill in your personal information

Once you’re done with the selfie, Personal Information screen will display.

Most of the fields were already auto-populated based on the details in the ID you provided.

ID INFORMATION

- ID Type

- ID Number

- First Name

- Middle Name

- Last Name

- Nationality

- Place of Birth

- Date of Birth

- Contact Number

CURRENT ADDRESS

- House Number and Street Address

- Country

- Province

- City

- Barangay/Municipality

- Zip Code

WORK DETAILS

- Nature of Work

- Source of Funds (Select all that apply)

- Cash on Hand

- Bank Account

- E-money

After filling in all the fields, tap NEXT. This will display the Review Information screen.

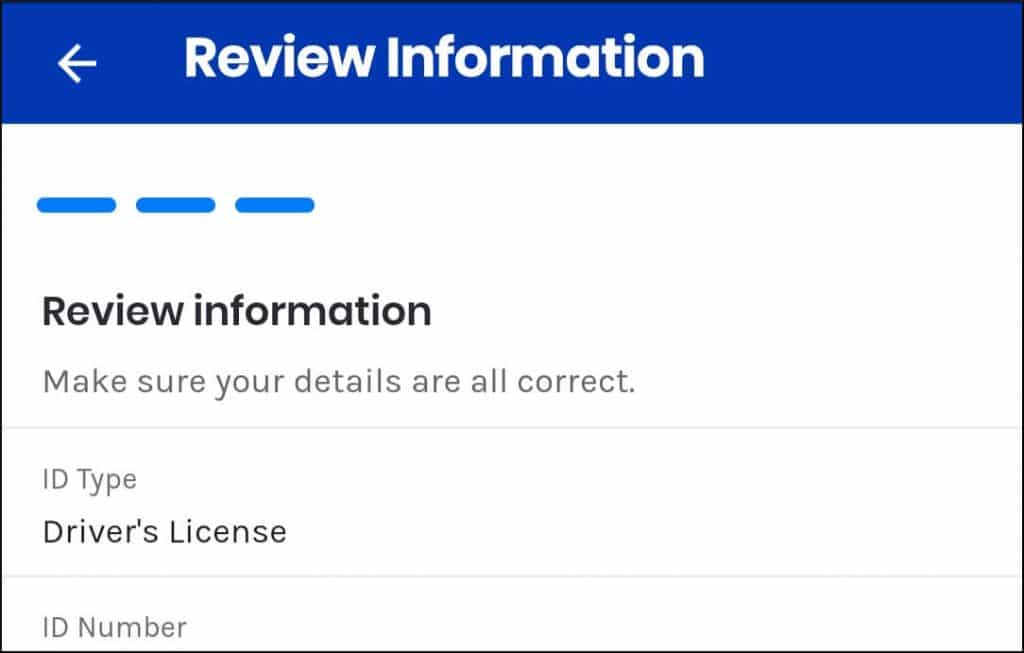

10. Review the information you provided

In the Review Information screen, check all the fields for incorrect detail or for any typo error.

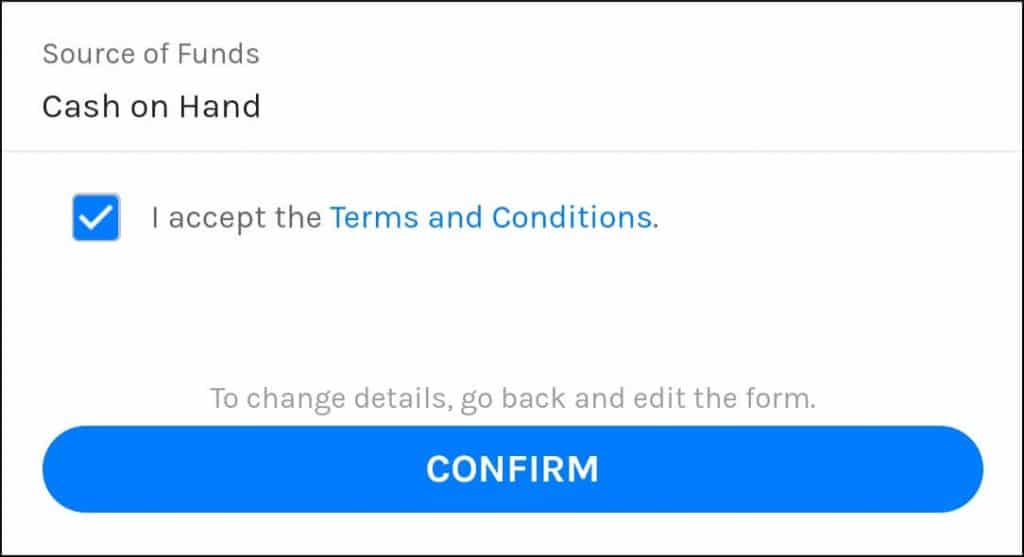

11. Tap ‘Confirm’ to fully verify GCash

After verifying that all details are correct, tap CONFIRM button.

After tapping CONFIRM, a new screen will display stating:

“Application submitted. We received your application. Please allow up to 30 minutes for us to review your application.”

An SMS will also be sent to your registered mobile number confirming the submission:

“Thank you for going through the KYC process Ref No. xxxxxxxxx. Please ensure that your registration details are true and complete to avoid deactivation of your account.”

After just a few minutes, a confirmation message was sent thru SMS that my account is already fully verified.

“Congratulations! Your account has been fully verified. Link your bank account or debit card to cash-in and enjoy more GCash features like Send Money, Bank Transfer, GSave, GCredit, and more!”

C. Now fully verified: What’s the difference?

Now that you have taken the above steps to fully verify your GCash account, what are the benefits of being fully verified.

GCash has different verification levels – Basic Level, Semi Verified and Fully Verified. Please note that in the above steps, the account transitioned from Basic Level to Fully Verified. Below are the available features for each verification levels:

BASIC LEVEL:

Basic Level available features:

- Offline Cash-in

- Pay Bills

- Buy Load

- AMEX Virtual Pay

- Pay QR

Basic Level Transaction limits:

- Wallet Size: 50,000

- Incoming Limit: 50,000 (Monthly)

- Outgoing Limit: 40,000 (Daily), 100,000 (Monthly)

SEMI VERIFIED:

Semi Verified available features:

- Offline Cash-in

- Pay Bills

- Buy Load

- AMEX Virtual Pay

- Pay QR

- GCash Mastercard

- Send Money

- Cash Out

- Request Money

Semi Verified transaction limits:

Wallet Size: 100,000

Incoming Limit: 100,000 (Yearly)

Outgoing Limit: No information

FULLY VERIFIED:

Fully Verified available features:

- Offline Cash-in

- Pay Bills

- Buy Load

- AMEX Virtual Pay

- Pay QR

- GCash Mastercard

- Send Money

- Cash Out

- Request Money

- Card Transactions

- Invest Money

- GCredit

- Online Cash-In

- International Remittance

Fully Verified transaction limits:

- Wallet Size: 100,000

- Incoming Limit: 100,000 (Monthly)

- Outgoing Limit: 100,000 (Daily), 100,000 (Monthly)

Additional notes on the above verification levels:

- A user can purchase GCash Mastercard at any verification level enumerated above.

- Money requests can be done by users at any level; however, only Semi Verified and Fully Verified persons can pay for that request.

- GCash Verification Levels screen also sets the difference between Semi Verified and Fully Verified levels. Aside from the difference in available features and transaction limits, Semi Verified is only valid for 1 year or until the account reaches the 100,000 incoming limits. When this limit is reached, the account will become Basic again.

Fully Verify GCash: Final Thoughts

With my GCash account fully verified, I am now excited to try the advanced features that this mobile app offers. I am especially curious about GSave, GCash Forest, and Invest Money.

To know more, You may visit the GCash official website.

1 Response

[…] If you want to cash in by linking preferred accounts to your GCash app, your account must be fully verified. This is also needed if you want to receive remittances. Not verified yet, you may check out this post: How to Fully Verify GCash Account. […]